It hasn’t been easy, but you’ve successfully created and built a great community within your box.

Your members and coaches certainly value the hard work, camaraderie, and measured results they enjoy on a daily basis, but what is that all worth? How do you put a value on the time, effort, and risks you took to build this community?

The value of your gym, and what drives that value, is something you should evaluate and track over time. You measure the performance and progress of your athletes in your box daily, so why would you treat your business any differently?

Reasons for Valuing Your Box/Business

Although you may not have a desire to sell the business today (or ever), there are still a number of other compelling reasons why you should treat valuation as an important metric – both personally and professionally:

1. Financial and Estate Planning. Your business may be (or may become) one of your most valuable assets. If you are applying for a mortgage or other personal credit, you should be able to list your business as an asset and contributor to your net worth. If you are planning your estate or drafting a will, you should understand the implications for your heirs.

2. Partnership Buy-Outs. If you started your box with a friend or partner, there may come a time when that partner has to move across the country or can no longer be a part of the business and would like for you to buy out their stake. Having a combined understanding of the businesses value over time will streamline this process.

3. Insurance. You may have business interruption insurance and in the event of an unforeseen shutdown, may need to justify the value of your lost income stream to file a meaningful claim.

4. Investor or Capital Raise Negotiations. It’s not uncommon for a business owner to seek outside investors to infuse capital to help grow their business. Often this comes at the expense of selling a piece of the equity in the business and having a firm and defensible position on valuation can be hugely beneficial for your negotiation process.

Box/Business Value Drivers

Which factors drive value for your affiliate? Let’s discuss some simple measures that you can focus on to better understand the overall value of your business:

1. Membership Structure Growth/Retention. Membership growth and retention are the leading indicators of a box’s health and can be peeled back to reveal the durability of your revenue base. Tracking membership growth tends to get the most attention from box owners, but membership retention can have a powerful, and long-lasting, impact on the value of your business. Having a formal foundations/on-boarding program can help both sides of this equation, augmenting membership growth while minimizing membership attrition. Membership contracts or a retention system can help mitigate month-to-month member attrition and provide stability to revenues, but owners should consistently monitor contract cancellation and renewal rates to evaluate the longer-term impact on their business.

2. Average Revenue per Member (ARM.) The total value of your client base goes beyond just monthly contract revenues. Strive to unlock additional value with additional services (personal training, barbell clubs, Olympic lifting programs, mobility programs, etc.) and access to peripheral services (chiropractic care, yoga, massage, etc.)

3. Coaching Staff and Compensation Structure. The more mature and professional this structure, the more succession-ready and valuable your business. Work to build an environment where the affiliate can run without you. A coaching program with formal training and defined roles (assistant coaches, head coaches, etc.) with coaches being compensated (not just free membership) goes a long way towards this goal. The more serious you are about this, the more serious your staff will be about their roles and how to progress in them.

4. Cost Structure and Current/Future Liabilities. The biggest single cost in most boxes is your facility lease. Given the generally long time commitment make sure you find the right location – ideally one that gives you room to expand (and handle all that membership growth) or allows you flexibility to move when you need a bigger, better space. Once you have your biggest expense covered, sweat the small stuff and look for ways to operate most efficiently.

5. Historical Profitability and Future Projections. As your business grows and matures, your ability to predict the future should improve and become more reliable. If you have done a great job with #1-4, this part becomes a modeling exercise since you have all the pieces in place to measure and project. You can’t make projections without #1-4.

With these elements visible and measured over time, you can better analyze trends to set a baseline for the future expectation of the business. These expectations are quantified through financial projections of profit, loss, and cash flow at your box, which in turn create the inputs necessary to help you assess the value of your business.

Valuation Methods & Tracking

Although there are a number of techniques for valuing a business (DCF, M&A market multiples, Comparable Company Analysis), one of the most common among smaller, privately owned companies is to use a Discounted Cash Flow (or DCF) analysis.

The DCF analysis utilizes the future earnings potential of the business to arrive at a current valuation based on the long-term growth of the business and doesn’t require external market information that isn’t readily available to you. Using the financial projections you created for your box, the DCF translates these future cash flows into today’s dollars – this not only accounts for the time value of money (i.e. a dollar today is worth more than a dollar in the future), but also for the inherent risk that the business may not perform as projected.

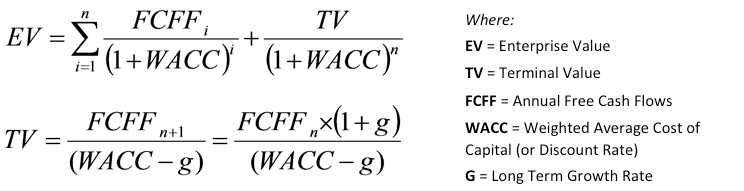

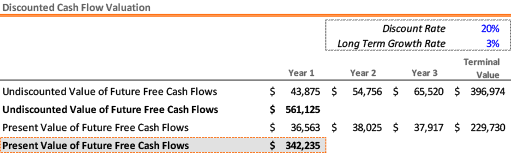

We’ll use a fictitious example to demonstrate at a high-level the key components of a DCF analysis and explain how you can use it to estimate the value of your gym. Our example is a box that today has 150 members paying on average $125 per month therefore generating $225,000 in revenue in year 1. We estimate growth in members and slightly higher average monthly fees in years 2 & 3 to provide the basis for our example. Follow along in Excel by downloading this free file and use it as a framework for creating your own. The “EV”, or Enterprise Value, in the table below is what we’re going to calculate:

Easy, right? Maybe not in those terms, but let’s take a look at the major components, keeping in mind that we are trying to convert the future earnings potential of the business into a value as of today.

1. Forecast Period. The forecast period captures the number of years of future cash flows we’ll individually project. We’re going to use a baseline of 3 years for our forecast period, since we’ll assume that over the next 3 years we can grow our revenues/cash flows faster than we can over the long-term (although not necessarily at our historical rate either). All else equal, the more established and stable the business, the shorter the forecast period.

2. Future Free Cash Flows. During the forecast period, we’ll establish projections for the future free cash flows (“FCF”) of the business. Our projections for the future potential of the business are based on the historical performance, adjusting for changes as necessary. In our example, we’ll use assumptions around a few key operating metrics to set our projections for FCFs.

3. Terminal Value. We also need to account for the earnings of the business beyond the forecast period, which is where the Terminal Value (“TV”) calculation comes into play. The TV is driven by the expected long term growth rate of the business as well as the assumed discount rate.

4. Long Term Growth Rate. This is the annual percentage increase in FCFs generated by the business. A good starting point for the Long Term Growth Rate (“LTGR”) is the annual inflation rate, which can then be adjusted based on the owner’s expectations for the business. The LTGR should be lower than the assumed Discount Rate, which we will discuss next.

5. Discount Rate. The Discount Rate (“DR”) allows us convert our projected future FCFs and TV into today’s dollars, accounting for (i) the time value of money ($1 today is worth more than $1 in the future), (ii) the uncertainty associated with the business’ ability to achieve the projections, and (iii) other risks associated with the business/valuation.

Putting it all together, the EV is the sum of the projected FCFs and TV of the business, translated into present value terms using the DR. The table below depicts the output from our example, where we have calculated a baseline value of $342,000 for our business, which has no debt (for a business with debt, subtract the net value of its debt to arrive at the value of the owner’s equity):

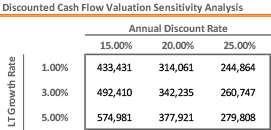

Using a sensitivity analysis, we can establish a realistic range for our baseline valuation, while also testing the impact of changes to our key assumptions. Continuing with our example from above, by varying the LTGR and DR, we arrive at a valuation range of $245,000 – $575,000 for the business.

Consider adding periodic valuation reviews (at a minimum annually and optimally quarterly) to your dashboard of performance metrics as another way to assess the health of your company. Just like training helps you perform better as an athlete, your business’s financial performance can improve with similar practice and discipline.

If you’re interested in learning more about evaluating the financial health of your affiliate or establishing financial projections for your box, don’t hesitate to reach out to the team at Rigquipment Finance. We’d love to meet you and have the opportunity to help.

[divider line_type=”Full Width Line” custom_height=”20″]

Guest Post by Joe Cormier

Joe Cormier is a founder of Rigquipment Finance, an independent commercial finance company dedicated to providing flexible funding solutions for affiliate gyms and boutique fitness facilities. Joe holds a CF-L1 certificate and is a member & coach at CrossFit Verity in South Riding, Virginia. After years of struggling to achieve the same level of fitness he had when playing Division I-AA college football, Joe saw the immediate benefits of the CrossFit methodology and was hooked. Rigquipment Finance sits at the intersection of Joe’s passion for CrossFit and his professional background. Joe graduated from Columbia University in NYC and has held CFO positions within a number of private and public companies, responsible for implementing strategic growth initiatives, overseeing mergers & acquisitions, and executing capital markets transactions.[/vc_column_text][/vc_column][/vc_row]